Remember when Dollar Tree used to actually sell things for a dollar? Or when fast food restaurants had a real dollar menu? It feels like our money is going down the drain, and the average human is losing our purchasing power.

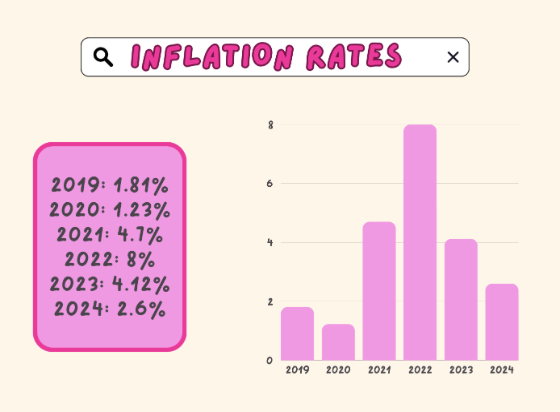

The current inflation rate is 2.6%, which is actually a stark improvement from previous years. We’re coming down from a high inflation rate of 8% in 2022 and then 4.12% in 2023.

Since 2019, there have been many ups and downs with the inflation rate. We are currently at a good inflation rate as the goal rate in the U.S. is between 2-3%.

AP Macroeconomics teacher at South Forsyth High, Jason Mendez states, “The problem is that there is a Lag time in when people’s salary adjusts to inflation which is going on right now.”

Although the inflation rate has decreased, we are having trouble adjusting after the vast inflation rate of 8% in 2022.

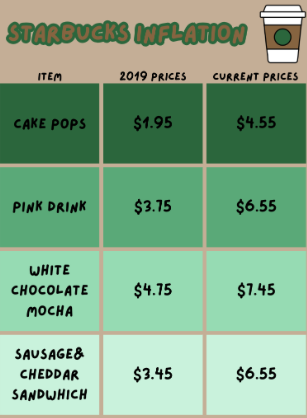

In 2019, the average price for a dozen eggs was only $1.38 and now in 2024, the average price is $3.82, which is a 176% price increase. These prices are also subjective based on brand and quality, so prices can end up even higher than that.

Rising prices are shrinking budgets

This inflation is affecting the average American’s quality of life, as with prices being this high, people have to budget and decide what they want to keep in their spending and what they have to give up.

“The purchasing power of the money has been eaten away because of inflation,” Mendez said.

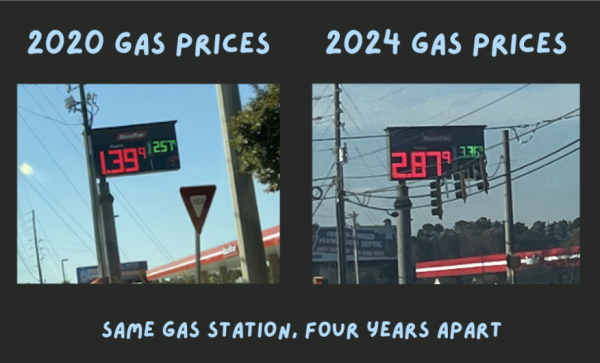

It has caused the prices of gas, groceries, and utilities to increase significantly, making it hard for consumers to afford to live.

Inflation ultimately ends up being more difficult for the lower and middle classes than the upper class.

“Lower and middle-income households spend a larger proportion of their income on necessities like food and housing, making them more vulnerable to price increases,” Mendez aid.

Purchasing regular things can feel like you are buying a luxury item because of the high prices compared to wages.

“Teachers salaries have not kept up with inflation since 1996,” Mendez said. “Yes, we do get raises every year… but the purchasing power of money [is much less] because of inflation.”

When salaries are not catching up to inflation, we are forced to budget and cut things out of spending until things are leveled back out.

How COVID-19 fueled inflation

2020 had a huge effect on the state of the economy. With COVID-19, spending came to a halt and many lost their jobs. When people are not spending their money, it affects the economy because there is a shortage of money flow. The government was worried that we would go into a recession and decided to take action.

Mendez said, “[The government] passed the CARES Act and The American Rescue Plan which put 5 trillion dollars into the economy” to prevent a recession, which it did.

Over time, however, it caused inflation as everything eventually caught up.

Now things are fixed and we are just adjusting, as Mendez said, “Inflation is too much money chasing too few goods which makes things more expensive and that is exactly what happened. There wasn’t enough stuff for the money people had.”

When the country had this surplus of money post-CARES Act, it caught up to us and prices were raised.

Corporate profits contributing to rising prices

Another suspect in this lasting inflation is corporate greed.

While the Consumer Price Index (CPI) has increased by 3.4% corporate profits have increased by 29%. Even though the CPI has gone up 3.4%, the input price for the manufacturers has only gone up 1%. This means that we are paying more money for the same product.

Corporate profits are suspected of contributing some of the inflation, as average profits rose by 53.9% post-COVID, but from 1979-2019 they only rose 11%.

These corporate conglomerates are power-hungry, while their consumers are just hungry.

For example, General Mills’ profit increased by 16.5% in 2022 during the inflation spike. In an interview, the company claimed that it was because it was “getting smart about how [it] looks at pricing.”

When big corporations raise their prices without accounting for consumer spending, with the sole purpose of making more profit, it leaves a bad taste in people’s already empty mouths.